No products in the cart.

It’s bad enough that the federal government has the audacity to tax your family 55 percent on the assets you leave them when you die (assets on which you’ve already paid income tax and capital gains tax in your lifetime). . You would think that taking 80 percent of everything you have acquired would be enough. You would be wrong. Another tax, known as the donation tax, will impose a 45 percent rate on any transfer of assets you make during your life.

The gift tax excludes transfers between married couples as husbands and wives can transfer as much as they want to each other. How generous it is of the federal government to allow you to transfer assets to a person with whom you most likely already share ownership of the assets.

Each year, a person is authorized to transfer $ 13,000 in cash or assets to any other individual without tax consequences. You can walk down the street and give out $ 13,000 to every person you meet and you’ll be fine. However, every dollar you give to a person over $ 13,000 will be taxed at 45%. If you want to buy a car for your teen and the car is worth $ 20,000, you need to fill out a donation tax form and pay the federal government $ 3,150 in tax for that year.

If you want to buy a house for your daughter as a wedding gift and the house is worth $ 150,000, you will need to pay a donation tax of $ 61,650. Even if you pay for the house monthly, through a mortgage, the federal government won’t wait. You will owe all $ 61,650 for that year’s tax return.

Incidentally, an easy way around this particular event would be to buy the house as an investment property for yourself and rent it to your daughter for $ 1,000 a month. So, you could give her $ 1,000 a month’s rent and avoid any taxation even if the total gift would only amount to $ 12,000 a year.

There are three main exceptions to the gift tax rule. You can give as much money as you want to your spouse without any taxable events occurring. A husband and wife can transfer billions of dollars between them and the government won’t care. This allows us to transfer assets for estate planning purposes. You can also donate as much money as you want to a legitimate charitable organization recognized by the IRS that has filed a 501 (c) (3) form and is approved as such.

The third exception to gift tax is that you can donate money or goods for the purpose of legitimate education or medical expenses. Many older people are able to successfully reduce their pending inheritance tax by providing their grandchildren with a college education through 529 prepaid college plans or programs.

Donation tax is a bad tax as it imposes a penalty for being generous. There are many ways to limit the amount of gift tax that you will be asked to pay during your lifetime. Only a few of these ways have been briefly touched upon in this article. For a complete overview of all the ways you can limit the taxes you pay during life and after death, you should consult with a Florida real estate planning attorney.

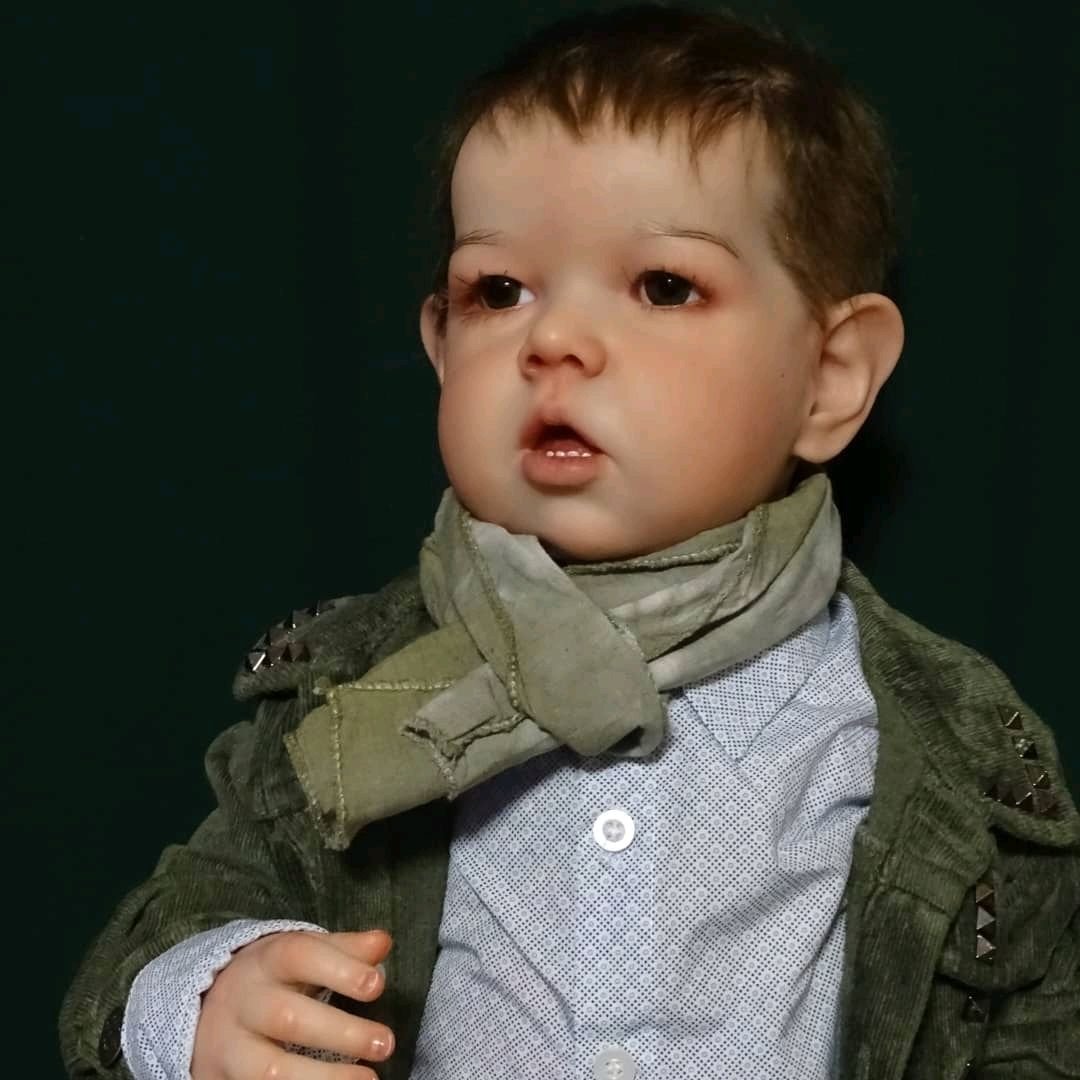

Handcrafted by Artists

Sweet House Reborns® offers a variety of unique and exclusive collectible reborn baby dolls, including many lifelike Baby Dolls, Newborn Toddlers, Sleeping Reborns, Boy Baby Dolls, Girls Silicone Babies, each crafted with exquisite craftsmanship and unmatched quality.

With a dazzling collection of reborn baby dolls, kids silicon dolls, smiling dolls, you’re sure to find a doll that will capture your heart. Get ready to experience beautiful creations, exquisite details and expertly tailored clothing when you shop our unique gallery of collectible reborn dolls. Plus, for the little doll lovers in your life, we also have dolls for children sure to inspire hours of fun. With so many dolls to choose from, it will surely warm your heart. Which one will have a forever home with you?

Make With Love

Sweet House Reborns® is a mom-owned and operated, eco-inspired and environmentally responsible reborn baby doll online store. Our mission is to keep our children safe and happy while supporting our sustainable fingerprint on the planet.

The overall philosophy of Sweet House Reborns® is that children and adults can live a life full of love with real life size silicone newborn dolls.

Children are gifts to the world, their hearts are filled with innocence and joy, and all adults were once children. Sweet House Reborns® always stands for pure love.